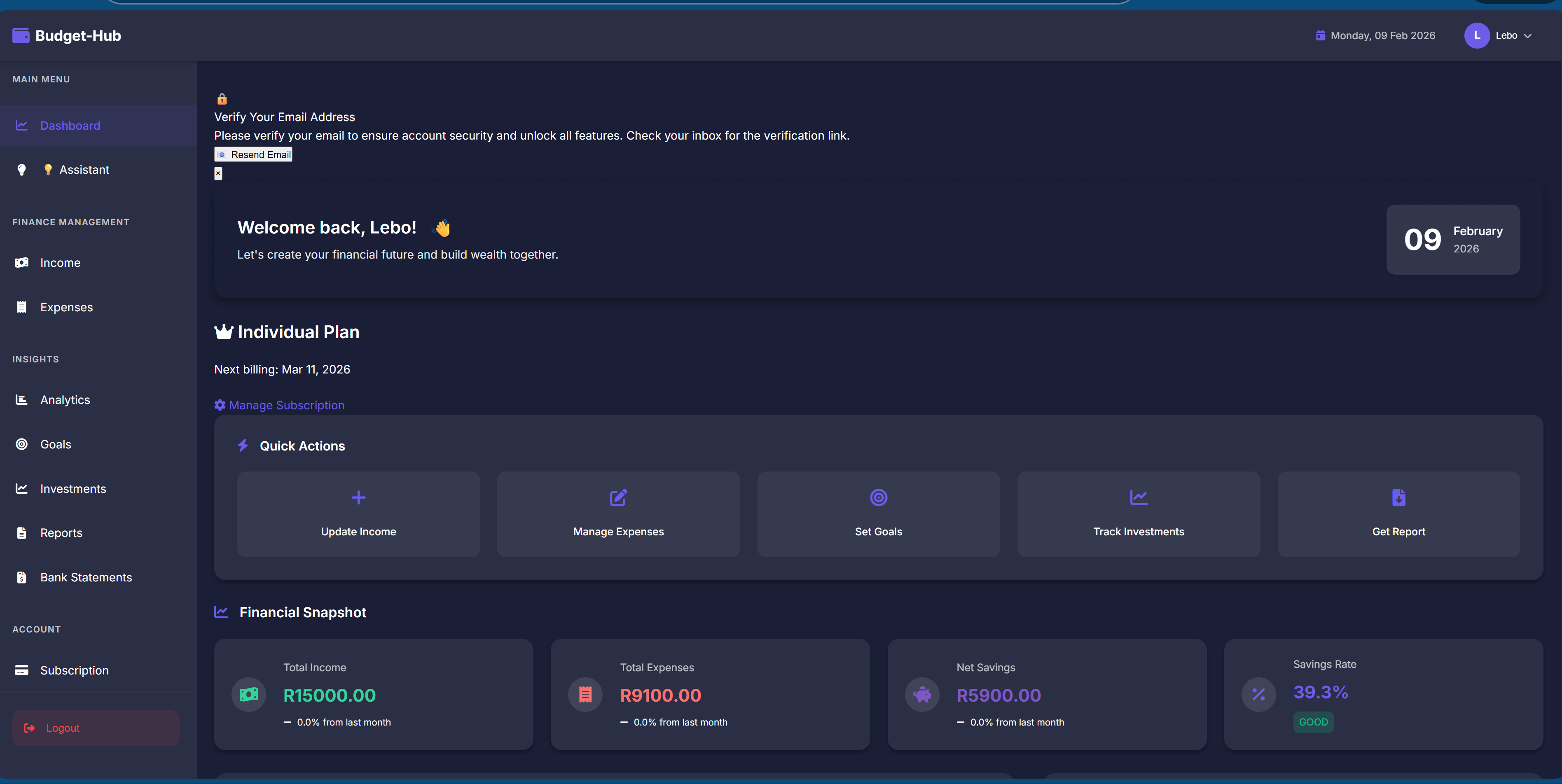

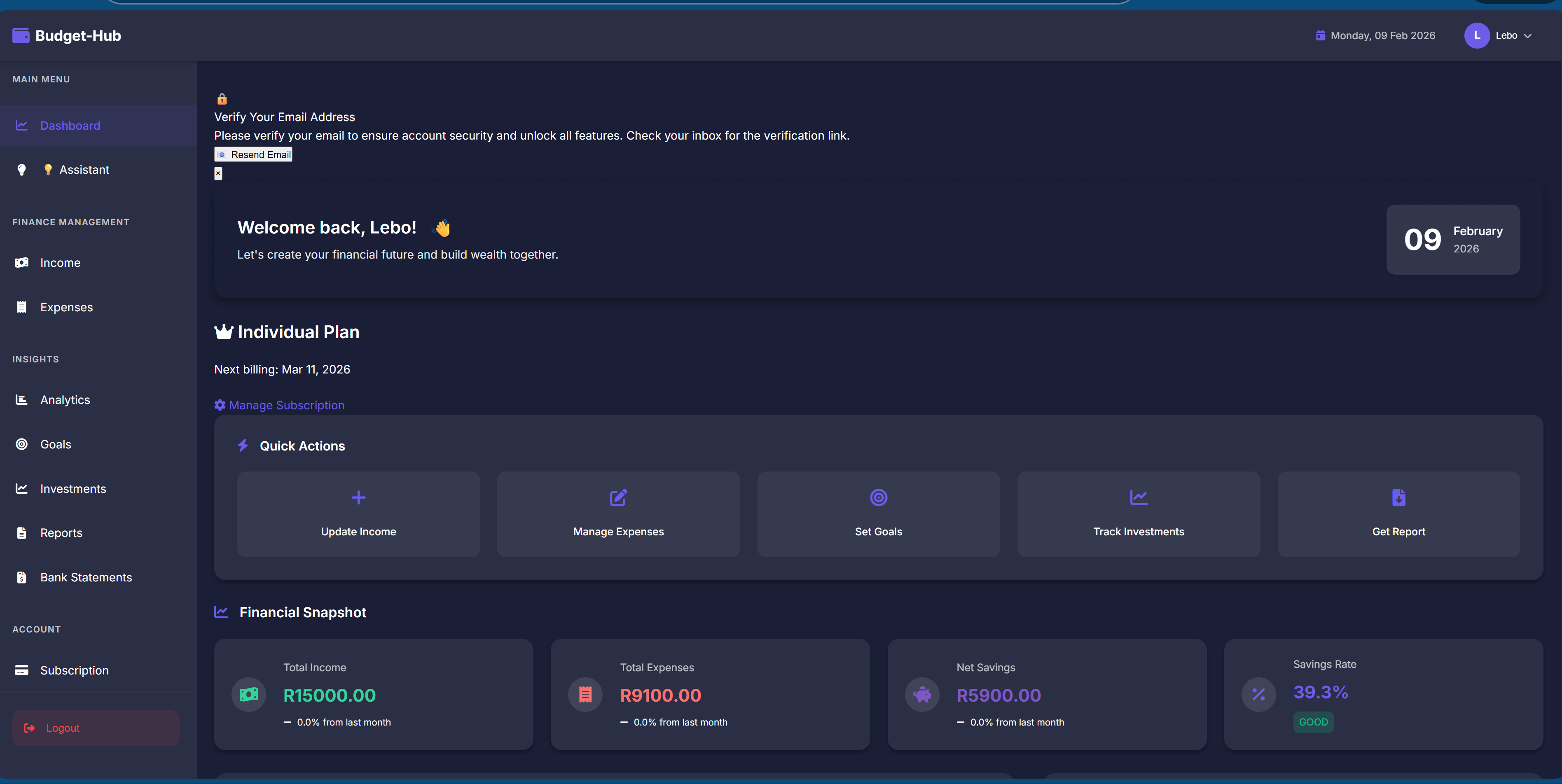

See Budget Hub in Action

A quick look at what you'll get from day one

Complete Financial Overview

Get real-time insights into your income, expenses, and savings. Track trends across 6 months with beautiful visualizations.

Budget Hub helps South Africans track spending, set savings goals, and build real financial clarity so you can stop guessing and start growing.

The tools you need, without the complexity you don't

See your full financial picture at a glance. Track income, expenses, and savings in real time with a clean, intuitive overview designed to keep you in control.

Understand where your money goes with detailed spending breakdowns, monthly trends, and category insights that help you spot patterns and save smarter.

Set a savings goal and see exactly when you'll hit it. Track your progress with milestones, earn achievements along the way, and stay motivated every step.

Monitor multiple asset types with automatic performance calculations. Track stocks, crypto, property, and more in one place.

Upload your Capitec, FNB, Nedbank, or ABSA statement and every transaction is sorted into categories automatically. No manual entry. No guesswork.

Download a clear summary of your finances whenever you need it. Perfect for loan applications, tax time, or just keeping your own records.

Budget Hub works like a native app, no app store needed. Add it to your home screen from your browser and open it just like any other app on your phone.

A quick look at what you'll get from day one

Get real-time insights into your income, expenses, and savings. Track trends across 6 months with beautiful visualizations.

Start free. Upgrade when you're ready.

Essential tools to get started

Perfect for personal finance mastery

Plug in your numbers and see what's possible

Great job! You're already saving above the target. Keep it up to reach your financial goals faster!

Here's what South Africans are saying

"I never really knew where my money was going each month. Budget Hub made it super easy to see everything in one place and I've already started saving more."

"The PDF reports are so clear. I actually look forward to checking my spending each month now, which is something I never thought I'd say!"

"I've tried a few budgeting apps before but they were all too complicated. This one just works and it's actually easy to stick with."

Quick answers before you sign up

Tips, strategies, and insights to help you master your finances

Supporting family is real life in South Africa, but your future still matters. Here is a practical plan to save without guilt, even when money …

Read MoreIf your money disappears over weekends, this guide helps you spot the real leaks, make easier choices, and stay in control without killing your social …

Read MoreMost South Africans struggle to build an emergency fund because the target feels impossibly far away. This two-step plan starts with a small buffer you …

Read More